Last Friday, the Kenya National Bureau of Statistics (KNBS) announced that inflation hit 9.2 per cent in September, the highest rate in 63 months. This resulted from a stubbornly high cost of living. Between August and September, maize flour prices rose by 8.4 per cent even as power prices went up by 20.9 per cent. Further to this, petrol prices shot up by nearly 20 percent, in the process hiking transportation costs by a staggering 25 per cent.

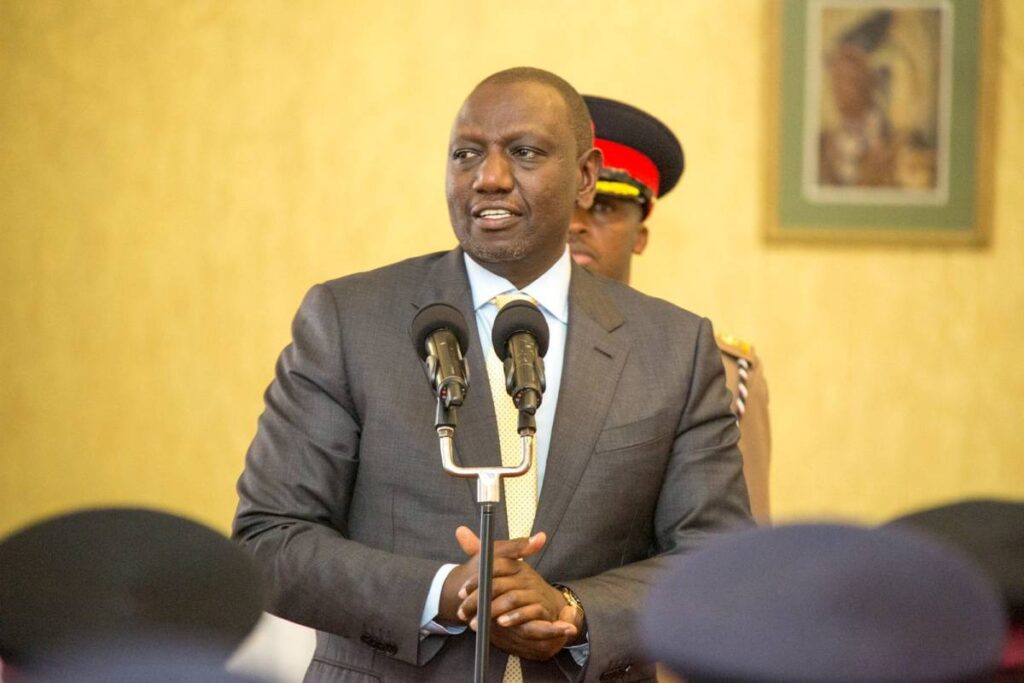

It is therefore gratifying to see the Ruto administration taking firm baby steps forward. But although the new administration is still in its infancy, the President has already pronounced himself boldly on the matter of small businesses. He is spot-on. After all, SMEs create 80 percent of employment in Kenya. During his speech to the joint session of parliament last Thursday, the President said that his government would allocate Ksh50 billion every year to the Hustlers Fund for MSMEs.

There is no doubt that the Hustlers Fund, if well executed, can provide much needed affordable credit for small businesses. Currently, such credit is virtually impossible to come across. The Youth Enterprise Development Fund provides a business loan product that attracts a single-digit interest of 6%. But there is a catch – the loan can only be secured through conventional security, which is a challenge for many youth.

Banks are worse. Some of the cheapest loan rates in the banking sector are at 13% interest rate. This effectively knocks out many small businesses as they simply can’t afford to service such high-interest loans. To make matters worse for them, last Thursday the Central Bank of Kenya (CBK) raised the key lending rate from 7.50 percent to 8.25 percent. This will likely lead to higher-interest bank loans, further marginalizing small businesses.

In the developed countries, affordable credit is often the norm, not the exception. Back in 2013, Britain’s Sainsbury’s Bank launched a personal loan rate of a mere 4.8% for three years. Despite this low rate, customers were allowed to borrow up to Sh2 million! It would be amazing for small businesses in Kenya, wouldn’t it?

The Hustlers fund seems intended to fill a gap that is currently not met by existing financial institutions but to ensure its success, transparency and accountability must be the norm. We must also be intentional in training to eradicate the culture of entitlement of free money.

Direct partnerships between The Government and renown manufacturers of tools of business that Kenyans regularly borrow to buy, may provide one of the possible fool-proof measures in Hustler Funds loan disbursements. In this bargain, the Government in a well thought out arrangement that involves umbrella associations would directly pay manufacturers of popular products like motorbikes, posho mills, tillers and water pumps. Using existing systems of recovery to reduce risk of default, the manufacturers would then supply the products of choice to Hustler Fund loanees. Both parties will get value for money. In addition, local manufacturing will be boosted, which will create more jobs for Kenyans. Further, this arrangement would save the fund from the high default rate that have plagued previous such funds.

In most businesses, it takes time for a Return on Investment (ROI) to be realized. It is therefore unrealistic to expect that small businesses will within weeks break even and afford paying back loans, however low the interest may be. The Hustler Fund therefore, ought to provide sufficient grace period before the loan repayment commences. Further to this and perhaps even more important, the Government should consider enrolling select small business owners into business incubation programs. This is what green money entails – it tackles the bigger picture in a sustainable manner. Think green, act green!